Introduction

The Mixed Xylene Market plays a critical role in the global chemical and petrochemical industries. Mixed xylene (MX) is a colorless, flammable liquid composed of a mixture of isomers—ortho-xylene, meta-xylene, para-xylene—and ethylbenzene. It serves as an essential raw material for the production of various industrial chemicals such as phthalic anhydride, isophthalic acid, terephthalic acid, and dimethyl terephthalate, which are key inputs in the manufacture of plastics, paints, adhesives, and coatings.

As industrialization and urbanization accelerate globally, the demand for xylene derivatives in automotive, construction, and packaging applications continues to rise. The market for mixed xylene is therefore directly linked to global economic activity and downstream consumption of petrochemical-based products.

Market Overview

The global mixed xylene market is experiencing steady growth due to increased consumption in solvents, coatings, and chemical intermediates. The market is driven primarily by robust industrial activity and infrastructure development in emerging economies. In recent years, the demand for para-xylene—used in producing polyethylene terephthalate (PET) for packaging—has also provided strong momentum to overall xylene production and trade.

The market is largely integrated into refinery and petrochemical complexes, where xylene is extracted through reformate streams or produced via catalytic reforming. Growth is also supported by rising demand for environmentally friendly coatings, which use mixed xylene as a solvent due to its favorable evaporation rate and solvency characteristics.

Key Market Drivers

- Expanding Petrochemical Industry

The petrochemical sector, particularly in Asia-Pacific and the Middle East, continues to expand rapidly, leading to increased production and consumption of mixed xylene. - Growth in Paints and Coatings

The paints and coatings industry is a major end-user of mixed xylene as a solvent. The ongoing growth of construction, automotive, and industrial maintenance sectors is fueling this demand. - Rising Demand for Plastic Packaging

The need for para-xylene in PET manufacturing for bottles, films, and packaging materials drives the mixed xylene market, as para-xylene is extracted from mixed xylene feedstock. - Economic Expansion in Developing Regions

Industrial development, particularly in China, India, and Southeast Asia, has led to the establishment of new refining and chemical plants that consume large volumes of mixed xylene. - Automotive Industry Growth

Increased automotive production boosts the demand for xylene-based coatings, adhesives, and plastics, contributing significantly to market expansion.

Market Restraints

- Environmental and Health Regulations

Stringent regulations regarding volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) impact the use of mixed xylene in solvent applications. - Crude Oil Price Volatility

As xylene is derived from crude oil, fluctuations in oil prices directly affect production costs and market dynamics. - Shift Toward Bio-based Alternatives

Growing sustainability awareness is pushing industries to seek alternatives to petroleum-derived chemicals, posing a long-term challenge to xylene producers. - Supply-Demand Imbalance

Regional overcapacity in Asia has occasionally led to price pressures in the global xylene trade.

Market Segmentation

By Type

- Ortho-Xylene

- Meta-Xylene

- Para-Xylene

- Ethylbenzene

By Application

- Solvents

- Paints and Coatings

- Adhesives and Sealants

- Chemicals (Phthalic Anhydride, Terephthalic Acid, Isophthalic Acid)

- Printing and Rubber Industries

By End-Use Industry

- Chemicals and Petrochemicals

- Automotive

- Construction

- Packaging

- Consumer Goods

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global mixed xylene market, with China, Japan, South Korea, and India being major producers and consumers. The region’s strong petrochemical base and high demand for plastics and coatings sustain growth. China’s large-scale PTA (purified terephthalic acid) and PET production plants consume significant volumes of para-xylene derived from mixed xylene.

North America

North America’s market is mature, with growth primarily driven by demand from the construction and automotive sectors. Technological advancements in refining and aromatics extraction contribute to stable production levels.

Europe

Europe’s mixed xylene market is influenced by environmental regulations and the region’s focus on sustainability. Nevertheless, steady demand from the automotive coatings and packaging industries supports moderate growth.

Middle East & Africa

This region is emerging as a significant player due to ongoing investments in petrochemical infrastructure and refining capacity, particularly in Saudi Arabia, the UAE, and Qatar.

Latin America

Growth in Latin America is led by Brazil and Mexico, where industrialization and infrastructure development continue to expand end-use consumption.

Market Trends

- Integration of Refining and Petrochemical Operations

Refineries are increasingly integrating aromatics and xylene production units to optimize feedstock utilization and enhance profitability. - Capacity Expansions in Asia

Several new mixed xylene and para-xylene plants have been announced in China, South Korea, and India to meet the growing regional and global demand. - Shift Toward High-Purity Para-Xylene

As PET demand increases, producers are investing in advanced technologies to maximize para-xylene yields from mixed xylene streams. - Adoption of Environmentally Friendly Solvents

Industries are reformulating products to reduce VOC emissions, which may impact mixed xylene consumption but encourage development of cleaner processing technologies. - Global Trade Realignment

Trade flows are shifting, with Asia exporting surplus xylene to deficit regions, while the Middle East increasingly becomes a hub for aromatics exports.

Competitive Landscape

The mixed xylene market is highly competitive, with major players investing in capacity expansions, strategic partnerships, and technological innovations to enhance yield and efficiency. Prominent companies include:

- ExxonMobil Corporation

- Shell Chemicals

- BP Plc

- Chevron Phillips Chemical Company

- Reliance Industries Limited

- China Petroleum & Chemical Corporation (Sinopec)

- LG Chem Ltd.

- TotalEnergies SE

- Formosa Chemicals & Fibre Corporation

- SK Global Chemical Co., Ltd.

These players focus on optimizing refining integration, upgrading catalytic reforming technologies, and enhancing product purity to cater to downstream demand.

Future Outlook

The Mixed Xylene Market is poised for consistent growth over the next decade. Increasing demand from the paints, coatings, and plastic packaging industries will sustain global consumption levels. However, the industry faces mounting pressure to transition toward sustainable and low-emission production pathways.

Emerging trends such as the development of bio-based aromatics, adoption of circular economy models, and refinery–petrochemical integration will shape the market’s evolution. Asia-Pacific will continue to lead production and consumption, while Europe and North America are likely to focus on efficiency and sustainability-driven innovation.

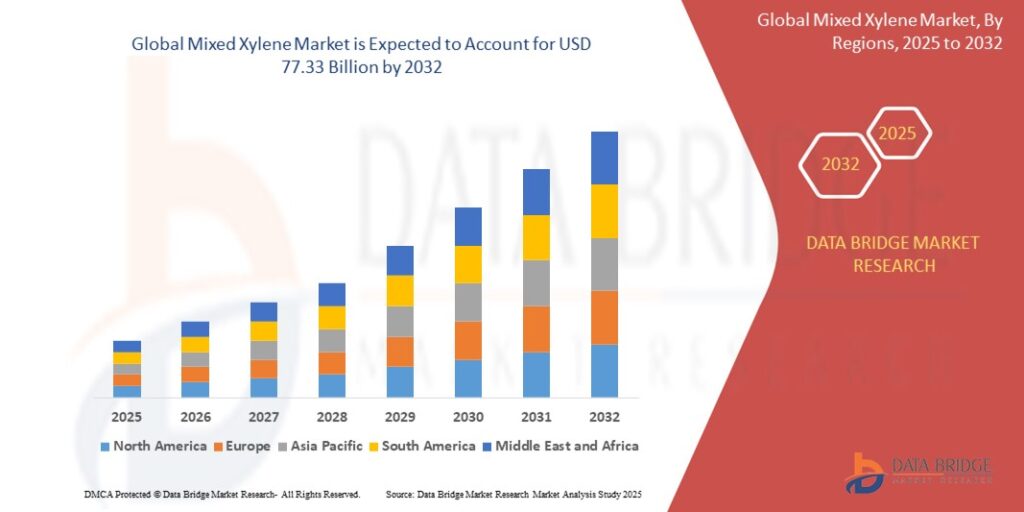

By 2032, the market is expected to expand significantly, underpinned by the growing global appetite for consumer goods, industrial coatings, and advanced materials derived from xylene-based feedstocks.

Conclusion

The Mixed Xylene Market remains a cornerstone of the global chemical industry, feeding critical downstream sectors such as plastics, paints, adhesives, and textiles. While environmental concerns and regulatory pressures may challenge traditional production models, ongoing technological advancements and industrial growth in emerging regions will keep demand robust. Strategic investments in efficiency, sustainability, and integrated production systems will define the competitive landscape for years to come.